Form 16 is an important document for every salaried taxpayer. It is a certificate–cum–income statement of each individual employee of an organization. Every employer, who deducts income-tax from the salary paid to employees where the income from salary exceeds the basic exemption limit and deposit the same with the government, issues TDS certificate showing how much salary (income) was paid to the employee and how much tax was deducted and deposited. Form 16 is issued every year after the close of the financial year by the employer to the employees. A salaried employee files his or her Income Tax return (ITR) on the basis of information given in Form No. 16.

Legal provisions related to Form 16

As per section 203 of the Income Tax Act 1961 read with Rule 31 of Income Tax Rules, 1962, an employer is required to issue a certificate in Form 16 to each and every employee from whom income-tax is deducted from the salary income in the prescribed format. The format is prescribed by the Central Board of Direct Taxes (CBDT) by issuing notification.

Recently the CBDT has issued Notification No. 36/2019 dated 12.04.2019 and amended the format of Form 16 and stated that the new format shall become applicable from 12th May 2019 for AY 2019-20 (FY 2018-19).

For Financial Year 2018-19 employers are yet to issue the Form 16 and hence the TDS certificate in Form No. 16 for the said financial year is required to be issued in new format only. However, if the employer issues Form No. 16 before the effective date of 12th May 2019 the employer may continue to issue the TDS certificate in Form 16 in the old or existing format.

Components of Form 16

Let us discuss the contents of Form 16 and then we will analyze the changes made in the new format of Form 16 with the old or existing format of Form 16.

Form 16 consists of two parts – Part A and Part B.

Part-A of Form 16: contains the general particulars of employer and employee and the quarter wise summary of the amount of income paid and TDS amount deducted and deposited. It also contains information about the period of employment with the employer issuing the TDS certificate in Form No. 16.

This part tells us for which Assessment Year Form 16 is being issued. It has also verification part in which the employer verifies the information contained in Form 16 as true, complete and correct as per records.

Presently, Part-A of Form 16 is generated and downloaded from the income tax department website (www.tdscpc.gov.in) by the employer and then is attached with Part-B of Form 16 before Form 16 is issued to the respective employees. Thus Part-A of Form 16 is an online downloaded portion of Form 16.

It also contains certain ‘Notes’ which are basically instructions in nature regarding filling the data in Part-A of Form 16. Since this part is downloaded from the income-tax department website, the notes are taken care of by the system itself.

Part-B of Form 16: provides information related to Income from salary of the employee to whom it is issued during the relevant financial year. It has details of all income by way of salary and perquisites and exempt allowances under section 10. All the deductions under section 80C, etc. and under chapter VI-A are as informed and submitted to the employer by the employee concerned are reported by the employer in the Part-B of Form 16. Finally, the tax liability of the employee on ‘Total Income’ after Rebate under section 87A and Relief under section 89 is given in this part.

Now by the Notification No. 36/2019 dated 12.04.2019, CBDT, the apex body of Income Tax, amended the Form 16 and prescribed the new format of Form 16 with changes. These changes are significant and are aimed in reducing tax evasion and wrongful claim of refund by the assessees in filing their personal Income Tax returns. Simultaneously, the data structure of the TDS return in Form No. 24Q has also been amended and is aligned with Form No. 16 and the Income-tax Return.

Comparison of Existing or Old Form 16 with New Form 16

What are the Changes made in the new Form 16 – a comparison of Existing or Old Form 16 with New Form 16

Part-A of Form 16: There is no change in the data reporting structure in Part-A of Form 16. However, the Notes appearing in the existing format of Form 16 is removed. In New Form 16, the ‘Notes’ in Form 16 will not appear. Some of these notes along with some new notes have been shifted and placed after Part-B in the New Form No. 16.

Part-B of Form 16: The Changes in New Form 16 which are amended in the Part-B of Form 16 are listed below-

All the serial numbers mentioned in the list given below are based on New Form 16 for AY 2019-20.

Serial No. 1 of New Form 16: Gross Salary: In sub-items (a) to (c), an employer is required to report -

a) Salary as per provision contained in section 17(1)

b) Value of perquisites u/s 17(2) (as per Form No. 12BA, wherever applicable)

c) Profits in lieu of salary under section 17(3) (as per Form No.12BA, wherever applicable)

Item (d) is the ‘Total’ of above three items in the existing or old format of Form 16 and new Form 16. Thus there is no change in Serial No. 1(a) to 1(d).

The New Form 16 missed one area of the amendment and that it did not amend the reporting requirement for 'Salary as per provisions contained in section 17(1)' in column 1(a) compared to old Form 16.

'Salary as per provisions contained in section 17(1)' in column 1(a) is required to be reported is in the same manner as was required in old Form 16. The new Form 16, unlike the exempt allowances, does not mandate an employer to report the component-wise break up of salary like Basic pay, Dearness Allowance, House Rent Allowance, Transport Allowance, Medical Allowance, Bonus or exgratia, Leave encashment, Gratuity, LTA, etc. Only one consolidated salary amount is required to be shown in column 1(a) of the new Form 16. The ITR 1 does not require component-wise break up of salary and only the consolidated amount of 'Salary as per provisions contained in section 17(1)' is required to be shown in the Schedule-Salary of ITR 1.

However, this is not the case for ITR 2 or ITR 3. In these ITRs component-wise breakup of salary is required to be shown. Therefore, a similar amendment in the new Form 16 is highly desirable. Though on a voluntary basis many employers do so, but no employer is mandated to do so. The same was the case for exempt allowances earlier but it has now been amended.

In case when old form 16 was in vogue even many employers were showing clause-wise exemption in Part B of Form 16. But after the amendment, there is no choice available with the employers and they have to compulsorily show the clause-wise exemption. Even those employers who were not showing the exemption on the clause-wise basis are now mandatorily required to show the clause-wise exemption. Amendment in Form 16 will force all the employers to show the information in a standard manner.

Had component-wise break up of salary been incorporated in the new Form 16 it would have been easier and better for an employee to file the tax returns in ITR 2 or ITR 3. If the employer does not provide the component-wise break up of salary in new Form 16 then those filing ITR 2 or ITR 3 shall on his own do the same from the pay-slips etc. It should be kept in mind that at the time of processing the tax returns, the income tax department will allow the exemption only if the relevant allowance is received by the employee which will be conferred from the break-up of salary reported in the column meant for reporting 'Salary as per provisions contained in section 17(1)' in the ITR 2 or ITR 3. For example, if the employee does not show the HRA in the salary break up and claims deduction u/s 10(13A) then his claim for deduction will be disallowed straight forward.

Therefore one should keep a note of this while filing ITR 2 or ITR 3. In the case of ITR 1 there are no such requirements and thus will not create any problem.

A new item or row (e) is inserted in the new Form 16 to report the ‘Salary received from the Previous Employer as informed by the employee’ by the current employer. There was no such requirement or place to report the same in the existing or old Form 16.

Serial No. 2 of New Form 16: Deduct Allowances exempt under section 10- This section has got significant changes although the header remains the same.

In existing or old Form 16, the amount of exemption may be given as a consolidated figure. However, some employers were giving a break-up of exemption under various clauses of section 10 voluntarily.

But the New Form 16 requires every employer to mandatorily report clause-wise exemption under various items serially numbered (a) to (g).

The new Form 16 itself contains the order of clauses of section 10 for reporting the exemptions as given below-

(a) Travel concession or assistance under section 10(5)

(b) Death-cum-retirement gratuity under section 10(10)

(c) Commuted value of pension under section 10(10A)

(d) Cash equivalent of leave salary encashment under section 10(10AA)

(e) House Rent Allowance under section 10(13A)

(f) Amount of any other exemption under section 10

(i) clause....

(ii) clause----

(iii) clause …...

….....

The item (f) requires to report the exempt allowances not mentioned in item (a) to (e) above, for example, Child Education Allowance, Hostel Allowance etc. All these other nature of exempt allowances should be mentioned or reported under item (f) as sub-item (i),(ii),(iii)...to maintain the parity of serial numbers of the new format of Form 16 issued by the employer to the employees.

Serial 3 of New Form 16: Balance amount – which the difference between Serial No. 1 and Serial No. 2 of the old or existing Form 16.

However, in the new Form 16, in Serial No. 3, Total amount of salary from the current employer is required to be reported which is the difference between 1(d) and 2(h). Please note that Thus, income from the previous employer(s) is not required to be included in the serial no. (3). It is included in serial no. (6) discussed below.

Serial No. 4 of New Form 16: Deduction for Entertainment allowance and tax on employment (popularly known as professional tax) is required to be reported in the existing or old Form 16.

In the new Form 16, ‘Standard Deduction’ is also included as this deduction is introduced and allowed from F.Y. 2018-19 or Assessment Year 2019-20.

Serial No. 5 of New Form 16: is the aggregate of deduction allowed under section 16 which is the aggregate amount of deduction under item 4(a) to 4(c).

Serial No. 6 of New Form 16: This gives the income chargeable under the head ‘Salary’. Income from previous employers in included here.

Serial No. 7 of New Form 16: In the existing or old Form 16, an employer is required to include any other income reported by the employee. The employer is required to report income under any other head of income in this serial as mentioned below-

Income (or Loss) from House Property

Income from Business or Profession

Capital gains

Income from Other sources

Significant changes have been made in Serial No. 7 of the new Form 16. Now employer can consider only income under the following two heads-

Income (or Loss) from House Property

Income from other sources.

Henceforth, the employer cannot consider income chargeable under the head ‘Income from business or profession’ or Income chargeable under the head ‘Capital Gains’.

Remember, the new Form 16 is notified on 12.04.2019 after the end of the previous year 2018-19. What if an employer has already considered income from say, business or capital gains of any employee reported to the employer in FY 2018-19. Well, this will not create any problem because new Form 16 will show the excess deduction of income tax from salary income.

Serial No. 8 of New Form 16: In the existing or old Form 16, this serial numbered as Serial No. 8 and represents the ‘Gross Total Income’.

In new Form 16, instead of numbering as 7(c), it is numbered as serial No. 8 and thus the order of serial of new Form 16 and old or existing Form 16 gets disturbed. In the new Form 16, serial number 8 represents the Total amount of other income reported by the employee and is the aggregate amount of Item 7(a) and 7(b).

Please note that there can be a loss under the head Income from House Property but there cannot be loss under the head ‘Income from Other Sources’.

Serial No 9 of New Form 16: In the new Form 16, this serial number represents ‘Gross Total Income’ which is the summation of serial no. 6 and serial no. 8 of new Form 16.

In the existing or Old Form 16, serial no. 9 contains the Deduction claimed by an employee under Chapter VI-A which is shifted down to serial no. 10 in the new Form 16.

Serial No. 10 of New Form 16: An employer is required to report the deduction claimed by an employee under Chapter VIA in Form 16 issued to the employees.

In the existing or old Form 16, this deduction u/c VIA is divided into two divisions – Division (A) and Division (B).

Division (A) is for Section 80C, Section 80CCC & Section 80CCD – the aggregate amount of deduction cannot exceed Rs. 1,50,000.

Division (B) contains other sections of deduction u/c VI-A viz Section 80D, section 80EE, section 80G, section 80TTA, etc.

In the New Form 16, all the deduction claimed by an employee is required to be reported under one serial number Serial 10(a) to 10(l). Serial 10(d) is the Total of Section 80C/80CCC and 80CCD(1) - aggregate amount of deduction for which cannot exceed Rs. 1,50,000.

Serial 10 (e) to 10(l) requires reporting of other deductions claimed u/c VI-A viz. Section 80DD, Section 80DDB, etc.

In the existing or old Form 16, item-wise deduction u/s 80C is required to be reported i.e. deduction claimed towards LIP, PPF, EPF, etc. In the new Form 16, an employer may report the deduction claimed u/s 80C on a consolidated basis which is in line with ITR.

In the new Form 16, item-wise reporting for the deduction claimed u/s 80C is not mandatory. One may report the same on voluntarily with sub-numbering under 10(a) to maintain the parity in the serial number of the items in New Form 16.

The new Form 16, now, expressly provides for deduction u/s 80G for donation to charitable institutions. Earlier, many employers were not allowing deduction for donation to charitable institutions but now after the amendment in Form 16 and express provision contained therein, an employer may allow deduction u/s 80G for donation to charitable institutions. However, the employer shall obtain proper receipts and proof of donation and eligibility to allow deduction u/s 80G from the employee concerned.

Serial No. 11 of New Form 16: In this column, the aggregate of the total amount of deduction allowed to an employee u/c VI-A is reported which is the summation of Serial 10(a) to 10(l). This is numbered as Serial 10 in existing or Old Form 16.

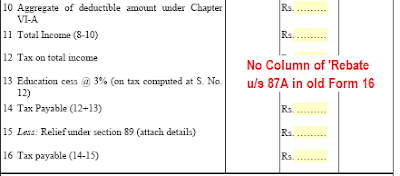

Serial No. 12 to 19 of New Form 16: These columns report the Total Income of an employee, Tax liability, Surcharge on income-tax, and Health and Education Cess on income-tax.

In the existing or old Form 16, there is no column to report the rebate allowed u/s 87A. The new Form 16 inserted a new column (Serial No. 14) to report the rebate allowed u/s 87A. For the assessment year 2019-20 (financial year 2018-19) rebate is allowed up to a maximum of Rs. 2,500 if the total income does not exceed Rs. 3,50,000. However, from AY 2020-21 (FY 2019-20) the limit is raised to Rs. 5,00,000 and the maximum rebate allowable is Rs. 12,500.

Read more on rebate u/s 87A on income-tax up to Rs. 12,500 here.

Both the existing or old Form 16 and New Form 16 ends with the column ‘Net Tax Payable’ and does not require to report income-tax deducted by the employer and final tax payable or refundable after TDS. However, the Part-A of Form 16 reports the total amount of income-tax deducted by the employer in quarter-wise sequence.

Both the New Form 16 as well as the old or existing Form 16 ends with the verification of the information contained in the Form No. 16 which is required to be signed by the employer either manually or digitally.

Notes to Form 16 - which are instructions in nature – are now appended after Part-B of new Form 16. In the old or existing Form 16, these notes were placed after Part-A.

Also Read:

Changes in Form 16-

To sum up, the significant changes introduced in the New Form 16 applicable from AY 2019-20 notified on 12.04.2019 vide CBDT Notification No. 36/2019 is given below-

Clause-wise exemption reporting– The New Form 16 requires an employer to report the exemption allowed under various sub-sections and clauses of section 10 separately. These exemptions cannot be clubbed or consolidated henceforth.

Income from Previous employer(s)– The New Form 16 contains a separate column for reporting of Income from the previous employer(s) by the current employer.

Income under other heads– The New Form 16 requires an employer to consider income or loss from House property and Income from Other sources only. An employer cannot consider income from any other heads viz. Income from business and Income from Capital Gains.

Deduction for donation u/s 80G– The New Form 16 expressly contain the provision for allowing deduction u/s 80G for donation to a charitable organization. An employer may allow the said deduction in new Form 16.

Notes to Form 16– The notes to New Form 16 which were placed in Part-A of the existing or old Form 16 are now appended below in the Part-B of the New Form 16.

The TDS return filed by the employer in 24Q has also been suitably amended to incorporate the changes or amendments made in Form 16. The notification also modified the data structure for reporting of salary data by the employers in Form 24Q. The information is now detailed more and made synchronized with Form 16 and ITR forms.

Due to changes in the data structure of Form 16 and TDS return Form 24Q, the CBDT has extended the due date of filing of Form 24Q from 31st May 2019 to 30th June 2019. Consequently, the last date of issue of Form 16 by the employers to employees also extended to 10th July 2019. However, till date there is no extension of the due date of July 31 for filing of income tax returns is notified.

Read more on:

Get all latest content delivered straight to your inbox

0 Comments