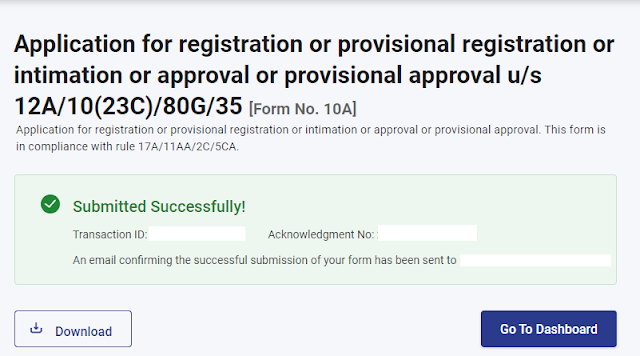

The filing procedure of Form 10A is enabled on the new e-filing portal of the Income-tax on 23rd July 2021 since it was launched on 7th June 2021. The initial time limit to furnish Form 10A was 30th June 2021 which was extended to 31st August 2021 by Circular No. 12/2021 dated 25.06.2021. Form 10A is applicable for filing of the application for obtaining registration under section 12AB and approval under section 80G of the Income-tax Act, 1961 (“Act”) by an NGO or a Trust. The Application in Form 10A is applicable for registration or provisional registration or intimation or approval or provisional approval. This form is in compliance with rule 17A/11AA/2C/5CA.

Finance Act, 2020 has introduced new registration systems of Charitable Trusts and NGOs completely revamping the existing procedure. It has also brought radical changes in the validity of the registration period of the Trusts or institutions/NGOs. Earlier, once registration was granted, the same remained valid for a lifetime unless cancelled. Now, after the amendment, every registration granted to a Charitable Trust or NGO shall remain valid for 5 years and is required to be renewed after every 5 years.

Introduction

At that time, it was provided that all the registered Trusts and NGOs registered under section 12A/12AA are required to apply for re-registration in the period between 1-6-2020 to 31-08-2020. However, due to the outbreak of COVID-19 pandemic and nationwide lockdown imposed, these provisions were postponed to 1-4-2021 by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020. This Act has deleted the amendments introduced by the Finance Act, 2020 which were effective from 1-6-2020 and again inserted the same provisions from 1-4-2021.

Recently, CBDT vide Notification No. 19/2021 has prescribed the rules for filing of the forms for re-registration u/s 12AB to be effective from 1-4-2021.

Due Date of furnishing Form 10A extended

CBDT vide Circular No. 12/2021 dated 25th June 2021 extended the date for furnishing Form 10A from 30th June 2021 to 31st August 2021. This has been done only due to the fact the new income-tax portal which was launched on 7th June 2021 could not make the Form 10A operational. This form was not available on the e-filing portal till 23rd July, 2021.

Overview of Form 10A

Form 10A was notified by the CBDT to enable trusts/NGOs to apply for migration of its registration to the new registration scheme as per section 12AB. Henceforth any application for registration of a trust shall be required to be made in form 10A. Further, application for approval under section 80G and 10(23C) shall also be made through Form 10A.

Note: There used to be an old Form 10A prior to the Notification No. 19/2021 dated 26-03-2021. This notification has substituted the old Form 10A with a new Form 10A. Further the scope of the new Form 10A is widened and covers not only application for registration under section 12AB but also covers section 80G, section 10(23C) and section 35.

New Form 10A is available for e-Filing on the new portal of the income-tax for registration or provisional registration or intimation or approval or provisional approval.

Further the same Form 10A is used for approval under section 80G and section 35 under Rule 11AA or 5CA apart from being notified for the purpose of registration under section 12A and Rule 17A.

New Form No. 10A notified for registration under section 12A from 1-4-2021

Form 10A is thus used for re-registration under section 12AB for trusts or institutions which are already registered or approved under these provisions prior to 1-4-2021.

New Form 10A is also used by trusts or institutions which are newly established and are applying for registration under section 12A for the first time.

Further, trust or institution which is in existence for many years but is never registered under section 12A is also required to use the new Form No. 10A.

Hence, the new Form No. 10A is used only for once in the lifetime of the trust or institution for registration or approval. For subsequent renewal, Form No. 10AB is required to be used.

Note: When an existing trust applies for new registration u/s 12AB, it will be given provisional registration. The rule requires one should apply for regular registration within a period of 6 months from the date of commencement of activities. Since in this case, the trust or institution has already commenced activities even before applying for the registration, one should remember that the trust will be given provisional registration first and then on the next day of receipt of provisional registration it should apply for regular registration. Since presently, application for regular registration is required to be applied in Form No. 10AB and the same is not yet released for online filing, one has to continue with the provisional registration till the online Form No. 10AB is released.

Who is required to file Form 10A for registration

From the above discussion, the following organizations are required to file for registration under section 12A in the new Form No. 10A:

Existing Registered Organizations: Organizations which are already registered under any of the erstwhile section 12A or section 12AA before 1-4-2021 shall apply for re-registration under section 12AB in Form No. 10A.

Existing Unregistered Organizations: Organizations which have already commenced charitable activities but are not registered with income tax authority under any of the erstwhile section 12A or section 12AA before 1-4-2021 shall apply for new registration under section 12AB in Form No. 10A. Such organizations will be given provisional registration for a maximum period of three years.

Newly Established Organizations: New Organizations which wish to get themselves registered with the income tax authority for availing exemption under section 11 and 12 of the Income-tax Act are required to apply for provisional registration in Form No. 10A.

When to apply for registration in Form No. 10A

Existing Registered Organizations seeking re-registration: Organizations which are already registered under any of the erstwhile section 12A or section 12AA before 1-4-2021 shall apply for re-registration under section 12AB in Form No. 10A within three months from 1-4-2021. Thus, the application in Form No. 10A for re-registration under section 12AB is required to be made within 30.06.2021.

Existing Unregistered Organizations seeking registration or New Organizations seeking fresh registration: Such organizations shall apply for re-registration under section 12AB in Form No. 10A for fresh registration within one month prior to the commencement of the previous year from which such exemption is to be claimed.

Documents to be submitted with Form 10A

The application in Form Nos. 10A or 10AB shall be accompanied by the following documents—

(a) where the applicant is created, or established, under an instrument, self-certified copy of such instrument creating or establishing the applicant;

(b) where the applicant is created, or established, otherwise than under an instrument, self-certified copy of the document evidencing the creation or establishment of the applicant;

(c) self-certified copy of registration with Registrar of Companies or Registrar of Firms and Societies or Registrar of Public Trusts, as the case may be;

(d) self-certified copy of registration under Foreign Contribution (Regulation) Act, 2010(42 of 2010), if the applicant is registered under such Act;

(e) self-certified copy of existing order granting registration under section 12A or section 12AA or section 12AB, as the case may be;

(f) self-certified copy of order of rejection of application for grant of registration under section 12A or section 12AA or section 12AB, as the case may be, if any;

(g) where the applicant has been in existence during any year or years prior to the financial year in which the application for registration is made, self-certified copies of the annual accounts of the applicant relating to such prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up;

(h) where a business undertaking is held by the applicant as per the provisions of sub-section (4) of section 11 and the applicant has been in existence during any year or years prior to the financial year in which the application for registration is made, self-certified copies of the annual accounts of such business undertaking relating to such prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up and self-certified copy of the report of audit as per the provisions of section 44AB for such period;

(i) where the income of the applicant includes profits and gains of business as per the provisions of sub-section (4A) of section 11 and the applicant has been in existence during any year or years prior to the financial year in which the application for registration is made, self-certified copies of the annual accounts of such business relating to such prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up and self-certified copy of the report of audit as per the provisions of section 44AB for such period;

(j) self-certified copy of the documents evidencing adoption or modification of the objects;

(k) note on the activities of the applicant.

[Rule 17A(2)]

Online furnishing and Verification of Form 10A/Form 10AB: Form Nos. 10A/10AB is required to be furnished online electronically.

Form No. 10A or 10AB shall be verified by the person who is authorised to verify the return of income under section 140 of the Act with digital signature (DSC) or EVC.

If the return of income of the applicant is required to be furnished under digital signature, then furnishing Form 10A/Form 10AB with DSC is compulsory else the forms can be furnished with EVC.

[Rule 17A(3)/(4)]

Passing of Order in Form No. 10AC

On receipt of an application in Form No. 10A, the Principal Commissioner or Commissioner shall pass an order in writing granting registration under section 12AB(1)(a) [for application made u/s 12A(1)(ac)(i) for an existing registered trust as on 1-4-21] or under section 12AB(1)(ac) [for application made u/s 12A(1)(ac)(vi) for a newly established trust] in Form No. 10AC and issue a sixteen-digit alphanumeric Unique Registration Number (URN) to the applicants.

Order in Form 10AC is passed for granting registration under clause (i) or (vi) of section 12A(1)(ac).

Clause (i) of section 12A(1)(ac) deals with the order granting registration to an existing registered trust or institution before 1-4-2021. As per section 12AB(3), the Pr. CIT or CIT is required to pass the order within a period of three months from the end of the month in which application in Form 10A is made.

Clause (vi) of section 12A(1)(ac) deals with the order granting registration to a newly established trust or institution. As per section 12AB(3), the Pr. CIT or CIT is required to pass the order within a period of one month from the end of the month in which application in Form 10A is made.

[Clause (a) or clause (c) of section 12AB(1) and Rule 17A(5)]

This shows that there will not be any inquiry or investigation by the Pr. CIT/CIT before granting the registration. In these two cases, granting of registration to the trust or institution will be instantaneous. In these cases, the income tax department cannot reject the application.

However, Rule 17A(6) prescribes to cancel the approval granted in certain circumstances.

It is prescribed that if, at any point of time, it is noticed that Form No. 10A has not been duly filled in by not providing, fully or partly, or by providing false or incorrect information or documents required to be provided or by not complying with the requirements of sub- rule (3) or (4) related to online filing and verification respectively, the Principal Commissioner or Commissioner, after giving an opportunity of being heard, may cancel the approval granted in Form No. 10AC and Unique Registration Number (URN), so issued and such approval or such Unique Registration Number (URN) shall be deemed to have never been granted or issued.

Effective date of provisional approval

In case of an application made under clause (vi) of section 12A(1)(ac) (a newly established trust or institution) during the previous year 2021-22, the provisional registration shall be effective from the assessment year 2022-23.

[Rule 17A(7)]

Types of Forms and its uses

In the matter of approval of an institution or a fund, the following Forms are in vogue as per Rule 17A:

Step by Step guide to file Form 10A on the new e-filing portal

How to online file Form 10A on the new e-filing income-tax portal

The step-by-step guide to online file Form 10A on the New E-filing Portal for obtaining registration under section 12AB is given below- (One may refer to this article for pictorial representations of the portal)

1. The user (trust/NGO) is first required to log in to its account by entering the USER ID and password on the log-in page after visiting the new e-filing portal.

This will ‘log-in’ the user in the new e-filing portal. The user can file the application in Form 10A only after successful logging.

Note: The interface of the new portal has been changed.

2. Click on the menu titled ‘e-File’ and then select ‘File Income Tax Forms’.

3. Go to Tab titled ‘Persons not dependent on any Source of Income (Source of Income not relevant)’.

4. In the Form Name column title ‘Tax Exemptions and Reliefs’, select ‘FORM 10A - Application for registration or provisional registration or intimation ……...’.

Click on ‘File Now’.

5. The PAN and submission mode ‘Online’ will be prefilled and cannot be edited. Fill the value in the field ‘Assessment Year’ as 2022-23.

6. Click on ‘Continue’ and then click on ‘Let’s Get Started’.

Before proceeding to the next page, one may pause and read the ‘list of documents required to file Form 10A’ and the ‘Instruction’ page of Form No. 10A’.

Documents list to help you file faster

● Details of Incorporation/Constitution such as Type of Trust/Institution, PAN etc.

● Details of Registration such as Relevant law/portal under which registered, Registration No. etc.

● Name, Designation & PAN of the Key Persons

● Details of Assets, Liabilities, Religious Activities & Income, if return of income filed for last three previous years

● Self-certified copy of the instrument creating the trust or establishing the institution, if any

● Self-certified copy of the document evidencing the creation of the trust, or establishment of the institution, if any

● Self-certified copy of registration with Registrar of Companies or Registrar of Firms and Societies or Registrar of Public Trusts, if any

● Self-certified copy of registration under Foreign Contribution (Regulation) Act, 2010, if any

● Self-certified copy of existing order granting registration under section 12A or section 12AA or section 12AB, if any

● Self certified copies of the annual accounts of the trust or institution relating to prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up, if any

● Self-certified copy of existing order granting registration under clause (23C) of section 10 of the Income-tax Act, if any

● Self-certified copy of order of rejection of application for grant of registration under section 12A or section 12AA or section 12AB, if any

● Self-certified copy of order of rejection of application for grant of registration under section 10(23C), if any

● Where a business undertaking is held by the trust or institution as per the provisions of sub-section (4) of section 11, Self-certified copies of the annual accounts of such business undertaking relating to such prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up and self-certified copy of the report of audit as per the provisions of section 44AB for such period, if any

● Any other relevant attachment

Instructions

General Instructions

● The session will expire automatically, if the browser window is idle for 15 or more minutes. Your session will time out in 15 minutes. Please extend your session by clicking "Continue Session".

● Size of each attachment should not exceed 5MB.

● All the attachments together cannot exceed 50MB.

● All attachments should be in PDF and ZIP (can contain only pdf) formats only.

● Please verify the Form before you submit.

Things you should know before filing

● This form is applicable to institutions, trusts, research associations, universities, colleges or other institutions, companies who wish to claim exemption under sub clause (i) of clause (ac) of sub-section (1) of section 12A, sub clause (vi) of clause (ac) of sub-section (1) of section 12A, clause (i) of First proviso to clause (23C) of section 10, clause (iv) of First proviso to clause (23C) of section 10, Clause (i) of first proviso to sub-section (5) of section 80G, Clause (iv) of first proviso to sub-section (5) of section 80G or Fifth proviso to sub-section (1) of section 35 of the Income-tax Act, 1961.

● E-verification is mandatory through DSC/EVC.

● Please ensure that the details of Principal Contact or Authorised Signatory has been updated in the My Profile before submission of the form.

● Please ensure that DSC of the Principal Contact or Authorised Signatory/Representative Assessee is registered before submission of the form.

The Instructions of the erstwhile portal are reproduced below which are equally valid on the new portal too with some modifications.

General Instructions:

1. While entering the data in online form, please do not click BACK button in browser or press BACKSPACE button. You will be logged out.

2. This Form is applicable to institutions, trusts. research associations. universities. colleges or other institutions, companies who wish to claim exemption under the following sections:

i) Sub clause (i) of Clause (ac) of Sub-section (1) of Section 12A.

ii) Sub clause (vi) of Clause (ac) of Sub-section (1) of Section 12A.

iii) Clause (i) of First proviso to Clause (23C) of Section 10,

iv) Clause (iv) of First proviso to Clause (23C) of Section 10.

v) Clause (i) of First proviso to Sub-section (5) of Section 80G,

vi) Clause (iv) of First proviso to Sub-section (5) of Section 80G,

vii) Fifth proviso to Sub-section (1) of Section 35 of the Income-tax Act, 1961.

3. E-verification is mandatory through DSC/EVC.

4. Please ensure that the details of Principal Contact or Authorized Signatory has been updated in the My Profile before submission of the form.

5. Please ensure that DSC of the Principal Contact or Authorized Signatory/Representative Assessee is registered before submission of the form.

6. It is a good practice to save your work frequently. Please use SAVE AS DRAFT option.

7. Attachments to the Form should be in pdf format only with scan clarity set at 300 DPI. If original document is illegible or in vernacular language, please ensure to upload a English translated version. neatly typed in A4 sheet. with 2.54 cms margin across all sides along with the original. The same can be attached at the time of upload.

8. Please verify the Form, accompanying attachments/documents before you submit.

9. All greyed out fields are either auto-filled or non-editable.

6. One will land on the main Application Form 10A which is divided into 8 sections namely,-

Note: Click on each section to expand the same even if there is no data to fill. Each and every section has to be ‘saved’ to mark all the sections as ‘completed’ with a green tick. Form 10A has 21 columns to fill in.

Each Column of each section is discussed below-

Section 1: Incorporation/constitution details

(1) The first part is general information in which most of the fields are auto-populated. Some fields are editable by the user. It contains the name, address, PAN of the applicant.

(2) The next column is Section Code. A drop-down box is provided to select the appropriate section code. There are 19 section codes listed in the column as listed below-

01-Sub clause (i) of clause (ac) of sub -section (1) of section 12A

02-Sub clause (vi) of clause (ac) of sub-section (1) of section 12A

03-Clause (i), of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (iv) of clause (23C) of section 10)

04-Clause (i), of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (v) of clause (23C) of section 10)

05-Clause (i), of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (vi) of clause (23C) of section 10)

06-Clause (i), of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (via) of clause (23C) of section 10)

07-Clause (iv) of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (iv) of clause (23C) of section 10)

08-Clause (iv) of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (v) of clause (23C) of section 10)

09-Clause (iv) of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (vi) of clause (23C) of section 10)

10-Clause (iv) of first proviso to clause (23C) of section 10 (for applicants covered under sub-clause (via) of clause (23C) of section 10)

11-Clause (i) of first proviso to sub-section (5) of section 80G

12-Clause (iv) of first proviso to sub-section (5) of section 80G

13-Fifth Proviso to Sec 35(1)-Clause(ii)-Scientific Research-Research Association

14-Fifth Proviso to Sec 35(1)-Clause(ii)-Scientific Research-University, college or other institution

15-Fifth Proviso to Sec 35(1)-Clause(iii)-Social Science Research-Research Association

16-Fifth Proviso to Sec 35(1)-Clause(iii)-Social Science Research-University, college or other institution

17-Fifth Proviso to Sec 35(1)-Clause(iia)-Scientific Research-Company

18-Fifth Proviso to Sec 35(1)-Clause(iii)-Statistical Research-Research Association

19-Fifth Proviso to Sec 35(1)-Clause(iii)-Statistical Research-University, college or other institution

In the context of section 12AB, there are only two references in the section code column-

Select the appropriate section code either 01 or 02.

Note: Remember, one should be very careful in selecting the code since as per Rule 17A(6) any approval so given is liable to be cancelled if any incorrect or false information is filled in Form 10A.

(3) The next information this form is asking is about the Nature of activity, whether the applicant is a Charitable, Religious or Religious cum Charitable. Select the appropriate one.

(4) The next information is related to the ‘Type of Constitution’ of the applicant viz., Trust, Society, Company and Others.

(4a to 4d) The details of registration under other laws is required to be given. For example, if an NGO is registered as a Society, then the society registration number needs to be given. In the ‘Authority granting registration/incorporation’, it shall be the Registrar of Societies that needs to be filled up. Almost all the approved institutions are registered somewhere under any other law. All the details including date of registration/incorporation can be found from the registration document/certificate. In case of section 8 companies, it will be the Registrar of Companies. MCA.

(5) In column 5, the Form asks for ‘objects of the Applicant’. It has provided 8 objects which are based on the definition of ‘Charitable Purpose’ as per Income-tax Act, 1961. The 8th item is the residual one. The Form listed the following Objects-

The applicant can select more than one object.

The applicant may refer to the memorandum of the organization to find out the objects. Remember, the latest objects as on the date of filing of Form 10A needs to be filled.

(6) Column 6 is about the revocability of trust. It requires an answer whether the applicant’s trust deed contains a clause that the trust is irrevocable. Since most all the trust has an irrevocability clause in the trust deed, the applicant needs to select ‘Yes’. This field is mandatory.

Remember that this column is made applicable for applicants which are registered as a ‘Trust’. But this form is required to be filled by a society, company also. There is no option to select ‘Not Applicable’ or alike. Hence, a society or a company shall also select ‘Yes’.

Click on the ‘Save’ button.

This completes section 1. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

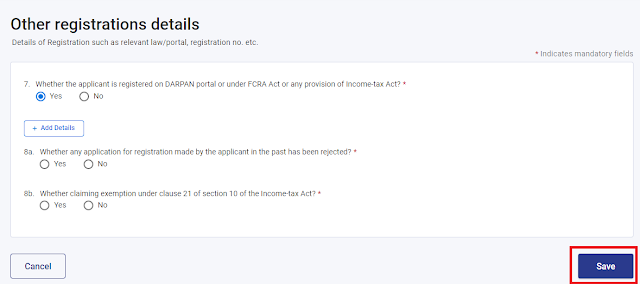

Section 2: Other registrations details

(7) This column asks for giving details of other registration under the following laws only-

(i) DARPAN registration

(ii) Registration under FCRA

(iii) Registration under Income Tax Act

In case of registration under the Income Tax Act, one should provide the existing registration details under section 10(46) and existing registration u/s 12A/12AA/12AB. Also, registration u/s 35 and Registration u/s 80G of the Income-tax Act is required to be given.

Note: The portal has wrongly used the term ‘Registration’ in case of 80G as ‘Registration u/s 80G of Income-tax Act, 1961’. This is because there is no ‘registration’ under section 80G, rather it is ‘approval’ for section 80G.

If the applicant clicks ‘Yes’, then the ‘Add Details’ button gets activated and then the user is required to click on the ‘Add Details’.

After filling the requisite details in columns 7a to 7d, click on ‘Add’.

Click on ‘Add Details’ once again to fill in other registration details. Repeat the process till all the registration details in column 7 are filled in.

On completion, click on the ‘Save’ button.

Section 10(46) exempts specified income of a body or authority or Board or Trust or Commission (by whatever name called) which is notified by the Central Government. For example, All India Council for Technical Education’, New Delhi, State Pollution Control Board, Odisha, Yamuna Expressway Industrial Development Authority, Uttar Pradesh, and many others are notified under this clause.

(8) Column No. 8 has two questions. One is asking whether in the past application for registration was rejected. Select ‘Yes’ or ‘No’, as applicable.

The next question in column 8b of Form 10A relates to claiming exemption under clause 21 of section 10 of the income Tax Act. Select yes if the applicant is claiming the exemption under section 10(21), else select ‘No’.

It should be remembered that section 10(21) is applicable to a research association approved for the purpose of clause (ii) or clause (iii) of sub-section (1) of section 35.

This completes section 2. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

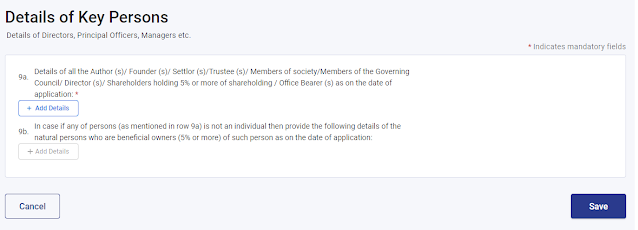

Section 3: Details of Key Persons

(9a) Click on the ‘Add Details’ button to open the details in the form.

It requires giving details of all the Author(s)/ Founder(s)/ Settlor(s)/Trustee(s)/ Members of society/Members of the Governing Council/Director(s)/Shareholders holding 5% or more of shareholding / Office Bearer(s) as on the date of application and their relation with the organization. The form has listed 18 types of relations whose information is required to be provided:

Managing Director

Director

Authorized Signatory

Trustee

Author

Settlor

Founder

Member of society

Member of the Governing Council

Shareholder holding 5% or more of shareholding

Office Bearer

Principal Officer

Person Competent to Verify

Principal Secretary

Secretary

Chief Executive Officer

Chief Financial Officer

Manager

Representative Assessee

Any other Principal Officer

In the field ‘ID Code’, any one of the following can be provided:

01-Permanent Account Number

02-Aadhaar Number

03-Tax Identification Number

04-Passport number

05-Elector's photo identity number

06-Driving License number

07-Ration card number

08-Others

Fill in the Address, e-mail and mobile number of each of the key person. The filed ‘Name of the Unique Identifier*’ is kept disabled and cannot be edited.

Once the information is filled in, click on the ‘Add’ button to add more key persons. This will open a new blank page to fill in details of the next key person as stated above.

Once completed and the details of all the key persons are filled in, click on the ‘Save’ button to complete the section.

In this column, the Aadhaar Number of the members etc. is optional and not mandatory, unlike FCRA registration. In place of Aadhaar number PAN, etc can also be provided.

(9b) In Column 9b, in case if any of persons (as mentioned in row 9a) is not an individual then provide the following details of the natural persons who are beneficial owners (5% or more) of such person as on the date of application.

This completes section 3. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

Section 4: Details of Assets and Liabilities

(10) Details of assets and liabilities. In this case, if the last return is filed, it will be prefilled ‘Yes’, other no will come.

If ‘Yes’ is selected, then click on the ‘Save’ button to complete section 4.

If ‘No’ is selected, then other columns 11 to 19 gets activated and one needs to fill in the following details-

Click on the ‘Save’ button.

This completes section 4. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

Section 5: Income Details

(20) Details of income of the applicant. It requires to fill the ‘Income received in three previous years immediately preceding the previous year in which application is made’.

In case the return for the previous year is filed, then no details are required to be added in this column. The ‘Add details’ button will be greyed out means the button is disabled.

Click on the ‘Save’ button to complete section 5.

In case the return for the previous year is NOT filed, then the ‘Add details’ button will be enabled and one needs to click on the button ‘Add Details’ to fill the income details of the last three years in the following fields.

Remember, in this ‘no return’ filing case, the heading of column 20 adds a red coloured asterisk mark to mean filling of details in column 20 is mandatory as shown below-

“20. Income received in three previous years immediately preceding the previous year in which application is made: *”

Click on the ‘Add’ button and then select next FY and after filling the data, click on the ‘Add’ button. This will add the data for the next FY and continue for the third FY.

Click on the ‘Save’ button

This completes section 5. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

Section 6: Religious activities details

(21) This section will be inactive.

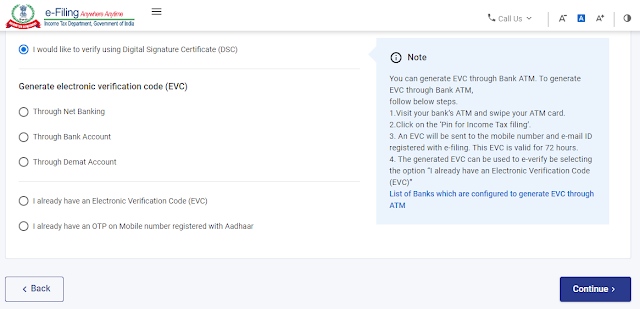

Section 7: Verification

8. Verification: At last, the form is required to be verified by DSC or EVC as per Rule 17A(3)/(4). The name, father’s name, nature of the constitution, as well as capacity, will be prefilled. One needs to fill the Father’s name field. In the ‘Place’, the IP Address of the computer is taken automatically by the software. ‘Name’ and ‘Date’ will be prefilled.

Click on the ‘Save’ button.

This completes section 7. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

Section 8: Attachments

9. Attachment of documents: This section of the form requires the uploading of scanned documents. The documents may be scanned in color or black and white. The size of each document shall not exceed 5 MB and the total size of all the attachments shall not exceed 50 MB. Hence, the applicant shall try to reduce the size of the pdf files if exceeding the limit.

Further, only PDF file format can be uploaded. No JPG or other image file is allowed.

The documents required to be uploaded is as per inputs provided by the applicant.

Click on the ‘Save’ button.

This completes section 8. Once the information/data are filled in, click on the ‘Save’ button. The data will be saved and then the main form page will be displayed with a green tick showing the status as ‘completed’.

Note: Same Form No. 10A is required to be furnished for registration under section 12AB and for approval under section 80G. However, for both sections, Form 10A is required to be filed twice, one for section 12AB registration and the second time for section 80G approval. Certain options vary in some fields in Form No. 10A for section 12AB and section 80G. In other words, separate Form 10A has to be filed for different provisions.

After all the sections are filled in, each of them will be green-ticked and the status will be shown as ‘completed’.

Preview

Click on the ‘Preview’ button. This will show the filled Form 10A. Applicant can go through it and recheck whether the information submitted is correct or there exist any mistake. If any mistake or error is noticed, the same can be edited. Users can also download the filled form.

Once the form is found complete, scroll to the bottom of the Form and then click ‘Proceed to E-verify’.

Once clicked on ‘Proceed to E-Verify’, a confirmation window will open which will ask ‘Are you sure you want to Proceed to e-Verify?’.

If you click on ‘Yes’, you will be taken to the next page where one needs to select the mode of e-Verification.

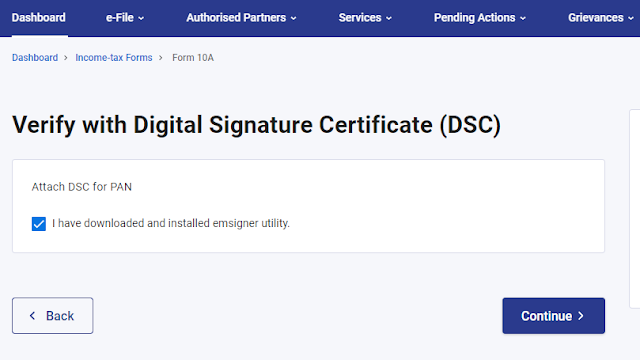

Click on ‘Continue’ to go to the next page. You will be asked to confirm whether the ‘emsigner’ utility is downloaded and installed.

Read more on ‘emsigner’ utility and How to Register DSC on the new Income-tax e-filing portal in this article.

On the next page, one needs to select the relevant signature and password and then click on ‘Sign’.

Also Read:

How to file Statement of Donation in Form No. 10BD

How to issue Certificate of Donation in Form 10BE

How to File Form 10A for Approval under Section 80G

Section 12AB and Form 10A: Procedure of Registration of a Trust and NGO

2 Comments

I am unable to receive otp at verification but website shows it as send

ReplyDeleteIam not able to enter after clicking "persons not dependent on ..."what to do next??

ReplyDelete